Cost Drivers

Configuration of Cost Drivers

LIMMOBI offers manifold possibilities to configure how the running costs of your real property are handled. The running costs are categorized over book keeping accounts. The corresponding accounts are automatically created when the ancillary cost of the real property are configured.

All running cost needs to be allocated to one of the following categories:

- At the expense of the owner (e.g. included in the rent)

- Lump sum: at the expense of the owner, but reimbursed by the lessee at a flat rate amount

- Allocated to lessees: cost is allocated to the lessees through the Ancillary Cost Statement

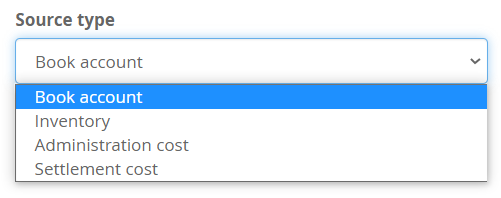

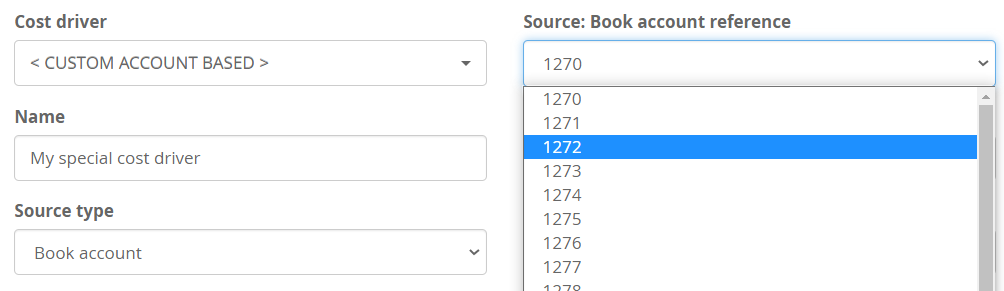

Cost Drivers are modelling the origin of the cost. LIMMOBI knows four main types of sources for cost:

Book Account: All transactions that are booked on a certain book account are considered as input of the cost driver. Most often this cost is originating from vendor invoices that are analyzed by LIMMOBI and the correct booking is suggested based on the invoice content. Other sources of transactions to a book account are manually booked transactions or transactions originating from bank account synchronization.

Inventory: Inventory based cost applies when there is a storage of fuel (or any commodity) where a first-in-first-out (FIFO) calculation should be applied to translate fuel purchases into expenses per calculation period. The most frequent example of this is heating fuel with a tank.

Administration cost: Administration cost is calculated as a percentage uplift to all or parts of the ancillary cost. It is only applicable to scenarios where an ancillary cost statement is created.

Settlement cost: Settlement cost is specific administration cost related to the collection of measurements and the calculation of allocated shares in a scenario where consumption counters are installed per lease unit. The separation of settlement and administration cost allows full flexibility to cover even the most complex scenarios.

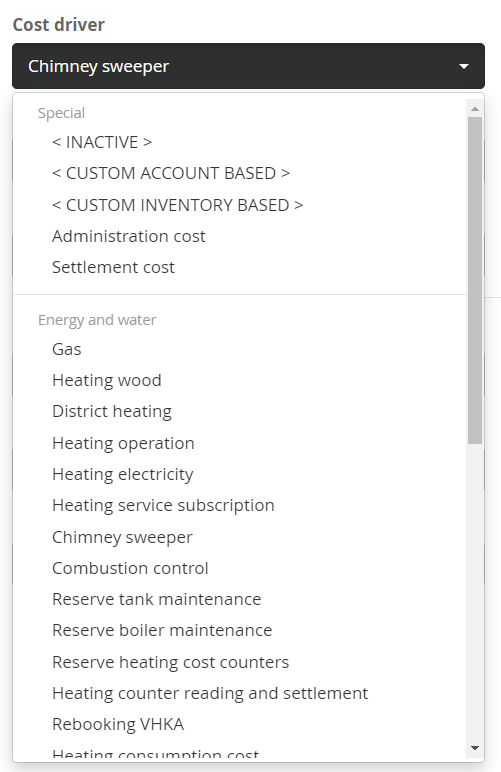

The most commonly used cost driver are pre-configured and can be chosen from the drop down.

For more extraordinary scenarios or if want to use custom account numbers, custom cost driver can be created.

Once the sources of cost drivers are mapped to cost drivers, it is time to define how the cost is allocated. There are two types of indirection that allow great flexibility:

- Distribution: Distribution allows to split up the cost driver's cost into multiple parts of individual allocation

- Allocation to Cost Collectors: Allows to aggregate multiple cost drivers into a single part that can be allocated to lessees. The typical scenario for this is heating cost which is aggregated from e.g. fuel cost, chimney sweeper, and a maintenance subscription.

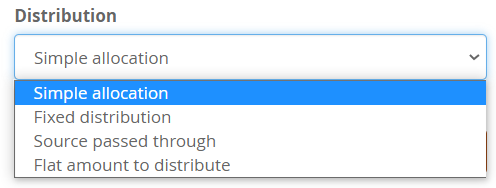

Distribution

Distribution allows to split up the cost driver's cost into multiple parts of individual allocation.

The following types are supported:

- Simple allocation: No split up, 100% to a single allocation

- Fixed distribution: Distribution across fixed shares. E.g. specifying 20 and 80 will distribute 20% and 80% for individual allocation

- Source passed through: Is a special case when cost should be reported on the ancillary cost statement with a certain cost collector, but not distributed together with the other cost

- Flat amount to distribute: Subtract a fixed amount from the cost and distribute the rest. Used for example if a fixed amount of the overall electricity cost should be allocated to heating cost as heating current.

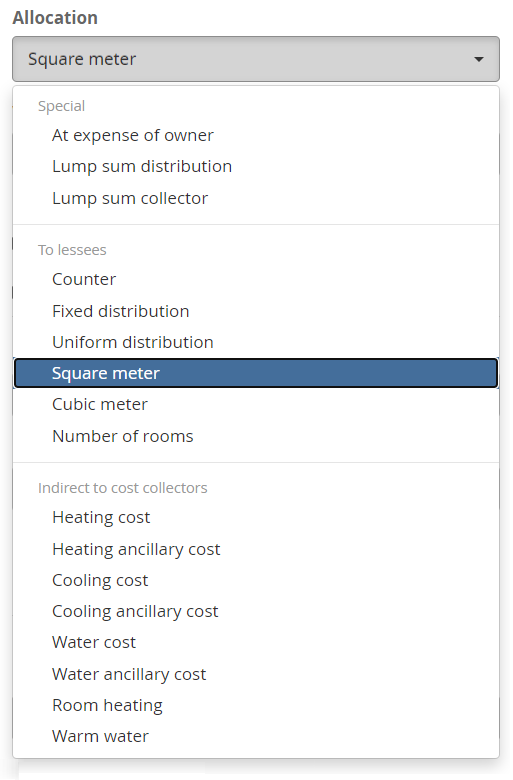

Allocation

There various options to allocate cost:

- Special

- At the expense of the owner: e.g. included in the rent, is default for self-occupied property

- Lump sum distribution: for rental property, when a fixed amount (Akonto) is defined for this specific cost type

- Lump sum collector: for rental property, when a capture-all fixed amount (Akonto) is defined

- Allocated to lessees: cost is allocated to the lessees through the Ancillary Cost Statement

- Counter: Allocate per counter on lease unit level

- Fixed distribution: Allocate per fixed ratio to lessees. E.g. cable tv, elevator cost

- Uniform distribution: Allocate equal shares to all lessees

- Square meter: Allocate per square meter of living space

- Cubic meter: Allocate per cubic meter of living space

- Number of rooms: Allocate per defined number of rooms of the lease unit

- Indirect to cost collectors for aggregation per cost type

- Heating, Cooling and Water cost can further be split to main cost and ancillary cost. This is to support the VEWA recommendation and allows more flexibility and allocation

- Room heating: Cost specific to room heating, exclusive of cost to heat water

- Warm water: Cost to prepare warm water

Customer support service by UserEcho